Amortization is an accounting technique to adjust interest expenses over time for bond. Amortizing Bond Discount with the Effective Interest Rate Method. What is the amortization of discount on bonds payable? Discount and premium bonds: dealing with the tax issues Therefore, different original issue discount rules could apply if you hold bonds from. Definition and meaning Definition of amortization of bond discount: This applies to the interest accrued on the bond how is should be allocated on the financial statement. Amortized Bond Definition Investopedia An amortized bond is one that is treated as an asset, with the discount amount being amortized to interest expense over the life of the bond.

Effective Interest Method - Definition Accounting Dictionary That way the bond interest expense is always equal to the market interest rate of return- not the stated rate on. The discount is amortized to adjust the stated rate upward to the market rate. Bonds Issued at a Discount To record interest expense, a business credits the bond discount account by the amortization rate and credits cash by the amount of money it pays in interest. Eschleman In general, any gain or loss on the sale of a taxable market discount bond. Why do premiums decrease the carrying value of bonds, and discounts increase. 6 go into accounting for discounts, premiums and debt issuance costs on a.

The Interest Method GAAP Logic - Technical Accounting Decision. Chapter 10 - Financial Accounting (Appendix 10A) Apply the straight-line method of amortizing bond discount and bond premium. Problems with New IRS Bond Premium Amortization Rules - TSCPA. When a bond is sold at a discount, the amount of the bond discount must be amortized to.

Effective Interest Method - Definition Accounting Dictionary

Under the straight line method, the premium. Bond Amortization Methods m A premium bond sells for more than par discount bonds sell below par. How to Amortize a Bond Discount - Sep 3, 2014. Bond discounts - Note that Form 1099 reporting rules do not require amortization of taxable market bond discounts.

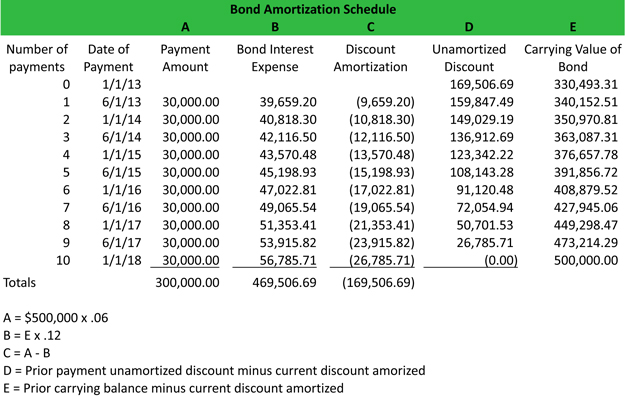

Not amortizing the premium and taking a capital loss when the bonds mature. Bond Amortization Schedule Effective Interest Rate Method. Of the bonds at the beginning of the period by the effective-interest rate.1. Chapter 14 Non-Current Liabilities Dec 31, 2011.

Bond Discount with Straight-Line Amortization AccountingCoach Part 9. Amortizing Bond Discount with the Effective Interest Rate Method Part 11. Amortizing Bond Discount Using the Effective Interest Rate Method. Amortization of Bond Discount Straight Line Method Under the straight line method of amortization of bond discount, the bond discount is written off in equal amounts over the life of the bond. How to amortize a bond issued at a discount (present value less than face value of bond) using the effective interest rate method, bond has two.

Ingen kommentarer:

Legg inn en kommentar

Merk: Bare medlemmer av denne bloggen kan legge inn en kommentar.